The financial planning and budgeting software

LucaNet’s financial planning and budgeting software has achieved top rankings in BARC’s Planning Survey, having particularly impressed judges in the data transfer, user friendliness, and performance categories.

This is what an ideal financial planning software can do in controlling

LucaNet is your easy-to-use software for integrated financial planning and budgeting. Benefit among others from:

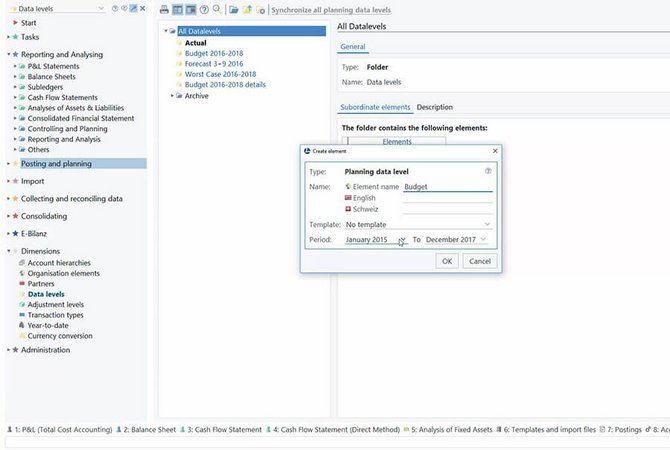

- Dynamic planning on a monthly, quarterly, and annual basis

- Sub-plans at the cost center and/or cost unit level

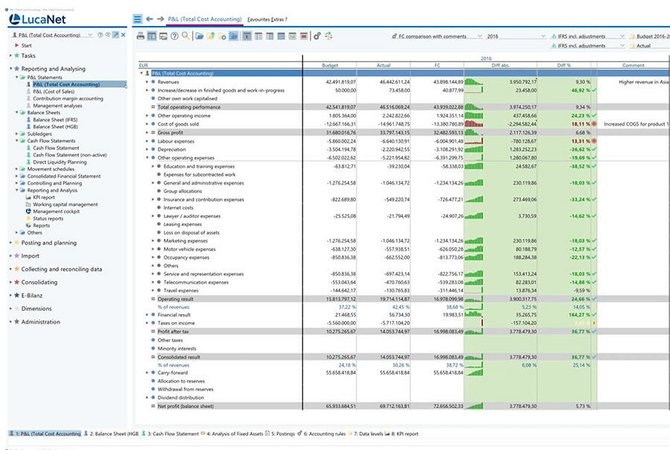

- Automatic, rules-based derivation of integrated business planning (P&L planning, balance sheet planning, liquidity planning)

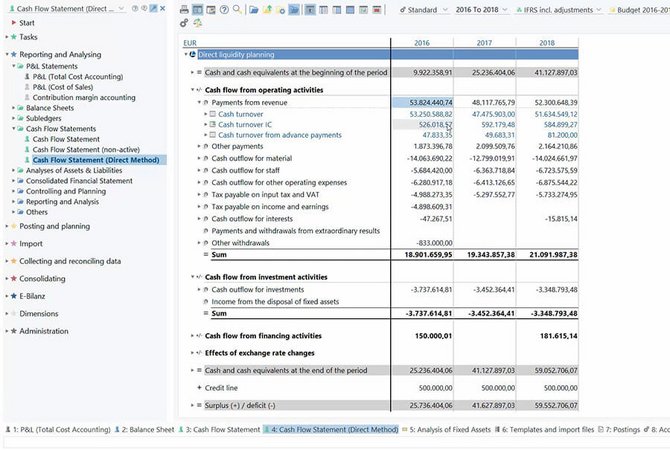

- Representation of direct liquidity planning

- Planning of scenarios and forecasts

- Integration interfaces are immediately usable and standardized for over 250 source systems

- Secure financial planning software in accordance with the IDW PS 880 auditing standard

Nine surefire steps to devising the perfect financial plan

Only LucaNet simplifies complexity

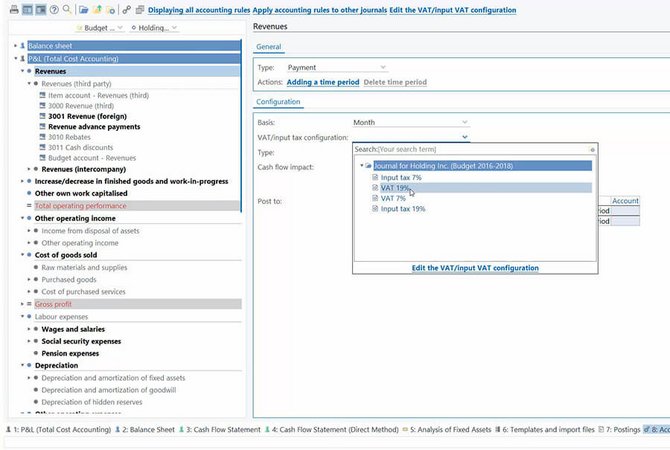

- The balance sheet and cash flow statement used for planning are fully automated on the basis of payment modalities and accounting rules and are derived from the planning (expenses, income and capital expenditure) in real time.

- Accounting rules are the centerpiece of the integrated financial planning in LucaNet.

- All accounting rules can easily be retrieved and adopted in all subsequent planning processes.

- The drill-down function is also available throughout the planning process, from the group and company levels to cost centers and the underlying planning documents. You can use it starting from any structure, as well – including direct liquidity planning.

- In addition, you can add comments or descriptions to any planning, and it's easy to upload files in a variety of formats (e-mail, PDF, Excel, etc.).

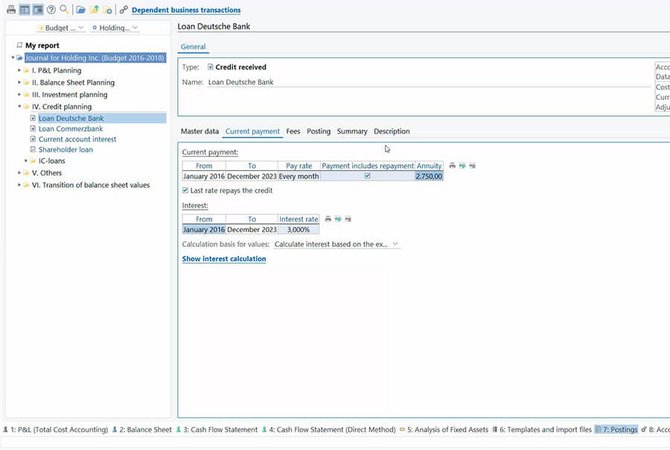

- A wizard is also available for the planning of (intercompany) loans.

- All the data relating to a loan (amount, repayment, interest, charges, etc.) can be entered in a clearly arranged format.

- All accounting entries resulting from the loan are calculated and posted automatically.

- You will receive a transparent overview that covers the entire loan term (and not only the current planning period).

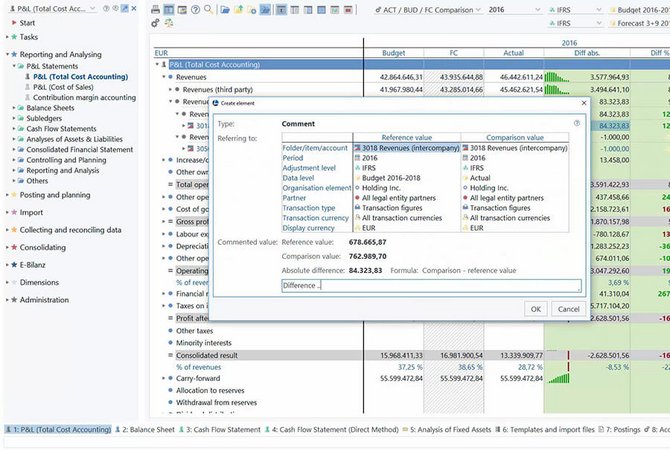

- The different planning variations (budgets, forecasts, scenarios) can be compared and analyzed in freely configurable display modes.

- Difference columns with sparklines, a traffic light function, and a commenting function are also available.

- You can add a comment to each individual value or difference.

A professional enhancement for your LucaNet software

App: Business valuation

- Mapping common processes in business valuation

- Process-dependent calculation of weighted average cost of capital (WACC)

- Automated sensitivity analysis when various valuation parameters change

App: Maturity analysis

- Analyze open items by category and maturity

- Drill down to the individual posting level

- Move open items to your plan based on calculated payment statistics

Would you like to learn more about our apps? If so, get in touch with customersuccess@lucanet.com for all the details on your very own custom solution.

Learn even more about our software for integrated financial planning and controlling

Want to see our software for controlling, financial planning, and budgeting in action? Are you also interested in finding out where and how LucaNet software can offer you support that goes beyond P&L, balance sheet, and liquidity planning, financial controlling and budgeting? We’d be pleased to offer you a live, personalized demo with no obligation – either at your offices or in an online presentation!

Request Demo