The software for group controlling

With LucaNet, you can say goodbye for good to error-prone reports and analyses. That’s right: no more endless hours cobbling together and reconciling financial data from myriad source systems and Excel spreadsheets, or entering new accounts by hand.

What you need in group controlling software

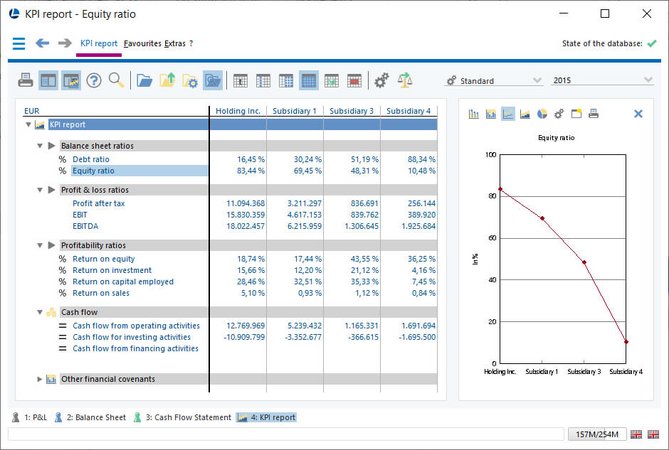

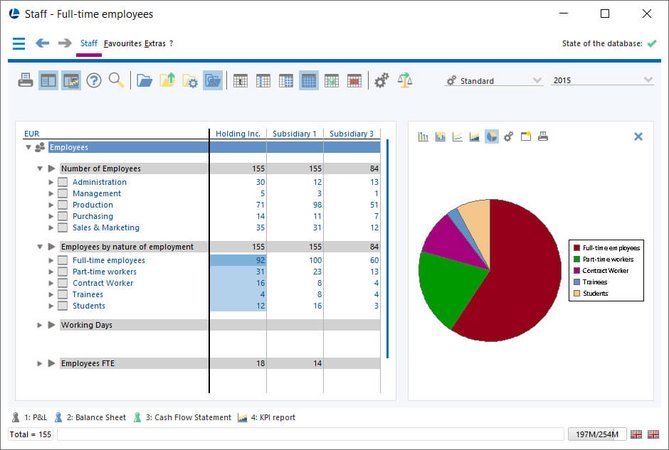

Our software for group controlling is sure to be the right tool for you thanks to all the functions it offers, which include:

- Presentation of actual and planning figures on a monthly, quarterly, and annual basis

- Best-case and worst-case scenarios

- Intra-year rolling planning and forecasts

- Transfer of existing planning from MS Excel and other data sources

- Ad-hoc reporting

- Interactive analysis function

- Charts

- Sparklines directly within value cells

- Management cockpit

- Custom report creation

- Full Excel integration

An intelligent solution for group controlling

How LucaNet can benefit you

Only LucaNet simplifies complexity

An intelligent enhancement for your LucaNet software

App: Business valuation

- Mapping common processes in business valuation

- Process-dependent calculation of weighted average cost of capital (WACC)

- Automated sensitivity analysis when various valuation parameters change

Would you like to learn more about our apps? If so, get in touch with customersuccess@lucanet.com for all the details on your very own custom solution.

Learn even more about our software for group controlling

Want to see our controlling software for group controlling in action? Are you also interested in finding out where and how LucaNet software can offer you support that goes beyond KPI analysis, contribution margin accounting, and the visualization of statistical information? We’d be pleased to offer you a live, personalized demo with no obligation – either at your offices or in an online presentation!

Request Demo