Round up of 2020 Accounting Trends

2020 was a whirlwind. This year will be remembered for how COVID-19 upended norms and caused a paradigm shift in our lives. It is also the year "who drove digital transformation?" jokes materialized - despite facing much resistance in the past, we embraced remote working.

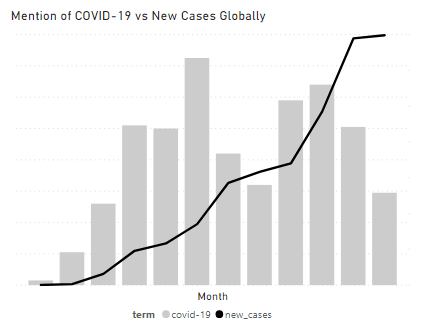

We discussed COVID-19 a lot. At its peak, a COVID-related word would feature every 60 words in the articles I analyzed. The peaks were in June and September, coinciding with when a large part of the world balanced with waves and recurring waves of infection. There is a surge whenever cases spike. However, despite record-levels of infections in November and December, it seems that accounting-related articles have shifted their attention to other topics. The virus is and will be, prevalent, but it appears that unless there are spikes in the number of cases, we will generally be less phased by it. This makes it conducive to usher in new norms.

With so much going on, it'd be nice to pause to take stock of what has gone on. I attempt this from the perspective of an accountant, for other Accounting professionals.

Having received the last weekly Google Alert for this year, I thought of using the top four-to-five titles from every week's digest to get a sense of what conversations our Accounting community engaged in. Here's what I learnt:

Key Themes for 2020

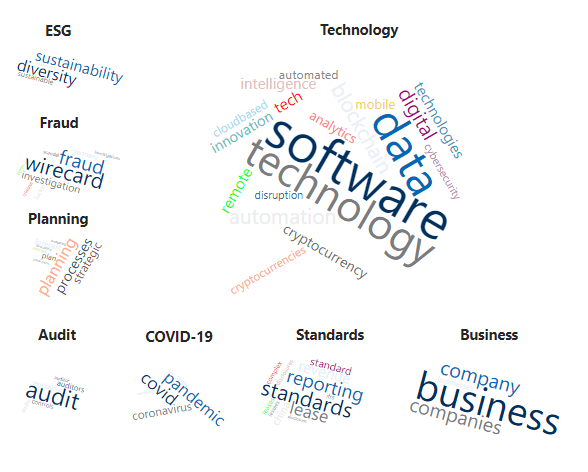

By grouping words of a similar theme, we can form segmented word clouds to get a taste of which words appeared most.

The word 'business' featured most. This grounds us in the fact that Accounting is, in fact, the language of business. Discussions on how to improve the Accounting process should result in benefits to the business - be it in cost-savings, value-adding, or data-driven decision making. Although Accounting departments are traditionally viewed as a compliance function, the decade ahead looks set to change that. The data that our industry has amassed adopting ERP / Accounting solutions is ready to bear fruit.

1. An Increased Emphasis on Technology due to COVID-19?

Accounting departments have picked up on technological advancements. In a Forbes article, J. Thompson postulated that "Automation will no longer be debated" in 2021, as part of a series of emerging trends. Other noteworthy terms that appeared were: "Analytics", "Blockchain", "Cloud-Based", "Cyber-Security", and "Cryptocurrency". The first four presents opportunities for application in an Accounting context, while the last is a topic that necessitates accounting judgement. Embracing these technologies is beneficial. These emerging tools will augment Accountants, and allow us to add value to the businesses we serve.

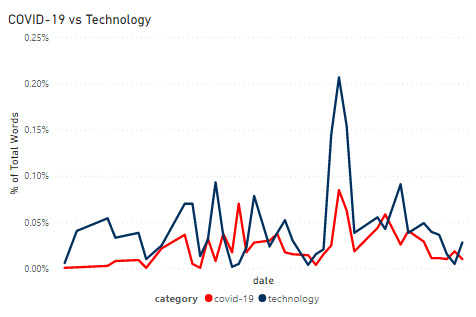

There appears to be a lagged correlation between the frequency in which COVID-19 and Technology terms feature in accounting-related articles. At the same time, or slightly after, COVID-19 is mentioned, technological updates are discussed. This spiked in September 2020. After a realisation that the coronavirus was not a short-term disruption, but a long-term one, more discussions on how to adapt took shape.

We have come a long way from paper ledgers to ERP systems, and now beyond. Our industry is at the tip of the iceberg for the next wave of transformation. Now that we have a good amount of historical transactional data, this can be used as a basis for forecasting our financial and operational expectations prospectively. There are opportunities to use statistical tools to make better forecasts. For example, (i) Regression Analysis, to obtain a more accurate forecast for revenue and expense categories, or (ii) Clustering, to identify trends and anomalies in spending. Or, to recommend key accounts to focus on nurturing.

The pandemic has seen an even more rapid pace of adoption across cloud and other services, and I hope it will continue to do so. For finance managers - the situation presents an opportunity to use the momentum and resources available to drive digital transformation in your organization for the better.

2. Inevitably, our Focus is Influenced by Reporting Cycles

What do we busy ourselves with?

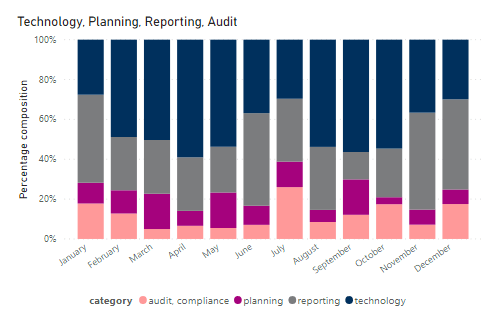

It appears the reporting cycle and its demands influence the topics discussed in accounting-related articles. This is potentially a reflection of what we focus on at different parts of the year. Given that approximately 70 % of listed companies feature a 31 December year-end, it is apparent that certain topics gain traction towards the end of the calendar year - like "accounting standards", or "tax" - as we gear up to finalize our reporting packages for the year.

Throughout the year, there are spikes in discussions on:

1. Planning and Technology (March. September)

These topics spiked around the same period. When we are recovering from a busy reporting and filing season, we make time to talk about improvements. This manifests in: (i) financial and strategic planning processes, and (ii) technological upgrades.

Accounting is, in fact, the language of business.

Planning comes in tandem with business decisions. Going forward, the expectation of accounting departments and the data it has will increase. Better data-driven decisions are on the horizon. This translates to a data requirement - apart from financial information, organizations need to capture information on the company's key operational drivers.

Building on the topic of digital transformation: if your organization is drafting its work plan and you're working where to slot projects of such nature in, this is a good indication of when - March and September. It would be good to plan and allocate resources to ensure project success.

2. Audit and Compliance (July)

This marked the peak of the accounting community's discussions on accounting fraud. The investigations into Luckin Coffee, Wirecard, NMC Health were rounding up, and the community began to weigh in more on these scandals. The ghost of Enron's past reverberated through these articles; we are not ready to move on yet.

In response to these accounting frauds, several countries have tightened up accounting regulations. For instance, Germany has returned the accounting watchdog function to BaFin, the financial regulator, giving investigations more regulatory power. The UK has also planned to increase the FRC's resources and expand its power for more regulatory power. The Big 4 firms have also agreed, in July 2020, to split consultants from auditors by 2024. This is a move that has been in the making for a long time.

As the accounting regulations toughen up, this could open up potential discussions on the application of blockchain, descriptive analytics, and creating greater transparency to improve the quality of financial information; to give stronger assurance on the financial reporting process a company undertakes. This is something to learn more about and watch as this space develops.

3. Reporting (November, December)

Although there is a spike towards the end of the year due to reporting requirements, there is a sustained interest in reporting requirements. This could be attributed to 2020 being the first year we reported using the new Lease standard (IFRS 16), and for many, the second year we reported in accordance with the new Revenue (IFRS 15) and Financial Instruments (IFRS 9) standard. Also generating some discussion is China's convergence with the IFRS on these accounting issues from 1 Jan 2021 - Revenue (CAS 14), Leases (CAS 21), and Financial Instruments (CAS 22).

The complexity of financial reporting remains. The challenge is in adopting new reporting standards and making accounting judgements. Daily transactional information - revenue, expenses, acquisition of assets - can be automated once the logic is defined. However, the new accounting issues and standards which emerge as businesses transform will keep as relevant, as we engage on how to best represent the economic phenomena that underpin these activities.

This year, the pandemic has undoubtedly created and altered our reporting requirements. For example, a Deloitte study revealed that 70% of companies reporting for a 31 March financial year-end disclosed COVID-19's impact on the firm, consistent with IAS 10. With most companies' financial year-end approaching soon, ISCA's list of technical resources may help with our reports on an unusual year.

That being said, while we observe these trends now, I hope that the lives of Accountants will not be dictated too heavily by the reporting cycle. In that emerging reporting solutions will enable Accountants to eliminate the mad rush and trauma of reporting at period end. That we can turn our focus to value-adding topics like 'planning' and 'technological advancements' more actively throughout the year.

3. Finally, Accelerating Sustainability as a Reporting Requirement

Incorporating sustainability reporting has been in the works. In the mid-2010s, several stock exchanges started the ball rolling by requiring listed companies to present a Sustainability Report - entailing disclosures on environmental, social, human rights, and anti-corruption matters. This allows us to gain a rounder understanding of a company's operations and societal impact. Such requirements incentivize management to play a role in being a responsible corporate citizen. As the world grapples with a climate emergency, this is much welcomed.

In late-2020, the IASB made an interesting proposition - a harmonized standard for sustainability reporting. There are various NGOs (SASB, GRI, etc.) that have already published a proposed standard for sustainability reporting. The IASB desires to utilize its expertise from setting Accounting standards to propel the discussion on Sustainability Reporting standards forward. Amongst the comment letters, a group of Accounting professors of Accounting conducting sustainability research accounting remarked:

Traditional corporate reporting, through what it counts and what it leaves as invisible, has led to significant environmental and human rights abuses and greater inequality between developed and lesser developed countries.

This could be exacerbated by another finding that "a significant number of investors ignore climate change and other sustainable development risks that have an impact on long term value creation. Largely, I believe that global sustainability standards are required - and should become the norm. However, the requirements in different jurisdictions vary significantly and should be carefully considered for the intents of sustainability reporting to be successfully achieved.

The pandemic has reminded us that there is no better time to act than now. IASB's involvement in discussions on sustainability reporting signals an opportunity for finance professionals - we could potentially value-add in this area too, in the ways we report and guide businesses.

The transition between 2020 and 2021 is no different than any other day; it is, after all, the turn of our clocks to midnight. However, in a year that saw an upheaval of countless norms, the talk of a "new year" brings about much-needed hope and renewal for many of us.

Change is, naturally, uncomfortable. Newton's First Law of Motion on inertia can be adapted to encapsulate our human tendencies. In 2020, the ball started rolling. Come 2021, when we embrace a new psychological 'chapter' of our lives - may this change bring about better outcomes for our profession and our societies as a whole.

Farewell 2020, and welcome 2021!