The Top 6 Questions on Handling Disclosures according to IFRS 16 with LucaNet

Although the mandatory initial application of IFRS 16 for IFRS accountants has been in place for some time, the application of the standard, which requires lessees to account for right-of-use assets and lease liabilities for both operating leases and finance leases, continues to be costly and time-consuming.

If you have to account for your leases in accordance with IFRS 16, both initial and subsequent measurement will be time-consuming. Excel solutions that you develop yourself can often only provide inadequate support in this practice.

In our blog post, you can read how our leasing solution can help you to easily overcome these challenges, not only in terms of initial and subsequent measurement, but also when compiling the disclosures in the notes.

Qualitative and quantitative disclosure obligations pursuant to IFRS 16

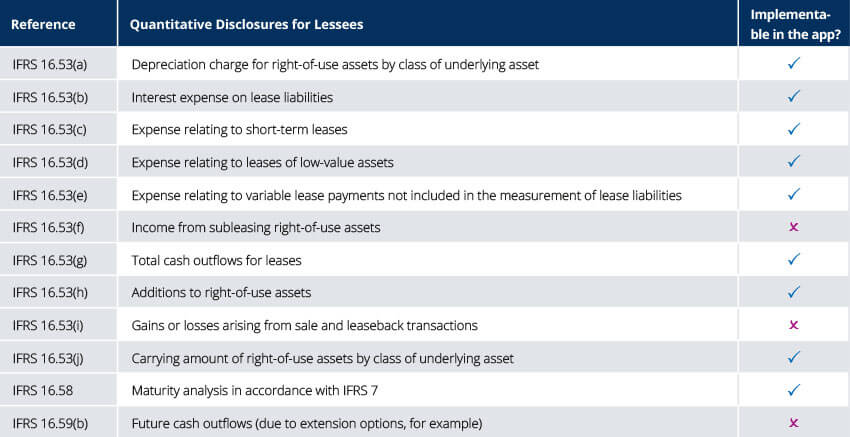

IFRS 16 includes extensive qualitative and quantitative disclosure requirements for leases. Luckily, LucaNet's solution for lease accounting makes it easy to generate the bulk of the quantitative disclosures. This blog article presents a condensed overview of the options at your disposal and answers the six most pressing questions:

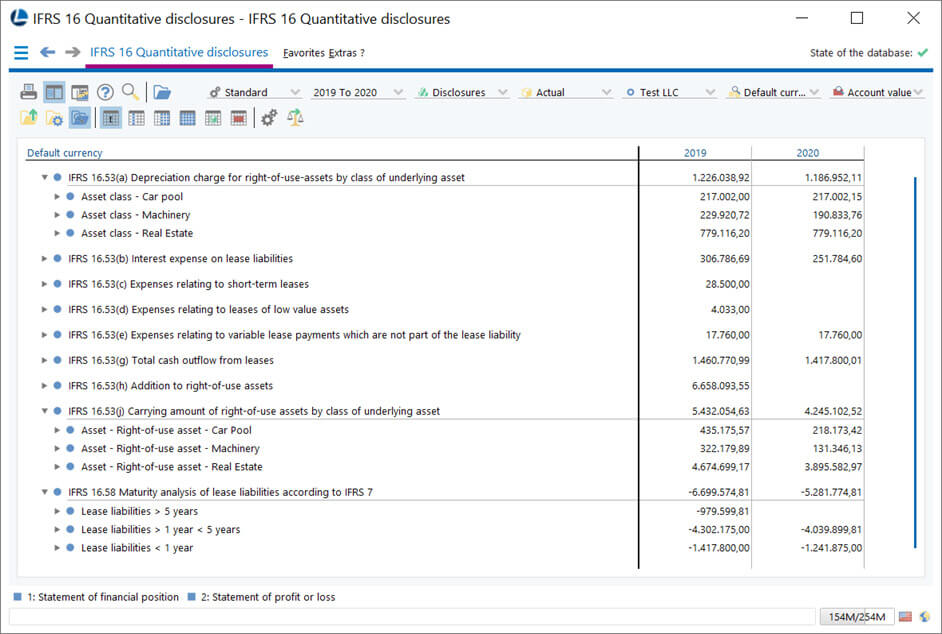

In the tool for lease accounting, quantitative disclosures are presented in a separate statistical ledger. The drop-down function makes it easy to bring up values pertaining to your individual leases in either the cost center dimension or the partner dimension.

Question 1: How do I proceed with disclosures for each asset class?

According to IFRS 16.53(a), lessees are required to present a breakdown of depreciation on right-of-use assets by asset class. With the solution for lease accounting, you can add an asset class to each contract as separate information and then append it to IFRS 16 accounts as a suffix. The individual asset classes will then be presented in a clearly arranged overview.

In addition, you can use the tool for lease accounting to break down to the carrying amounts of right-of-use assets by asset class in accordance with IFRS 16.53(j).

Question 2: How can I manage expenses relating to short-term leases and leases relating to low-value assets?

According to IFRS 16.6, recognizing assets and liabilities for short-term leases (those lasting no longer than one year) and leases involving underlying assets of low value is optional. If you take advantage of this exemption, you will need to disclose the expenses from such contracts separately in line with IFRS 16.53(c) and (d). The tool for lease accounting provides for clear separation of the related expenses. An exemption also applies to short-term leases lasting no longer than one month. In this case, you are not required to include the corresponding expenses in the disclosures.

Question 3: How do I proceed with expenses for variable lease payments that are not included in the lease liability?

Variable lease payments that are not linked to an index or price are to be recognized as expenses and not included in the measurement of the lease liability. In this case, however, you must disclose these expenses in the notes. Since the tool will post these expenses to a separate account, they can also be displayed separately in LucaNet.

Question 4: How should I manage the cash outflow for leases?

Since the tool performs all postings along with the corresponding transaction types, you can view the entire cash outflow for leases in LucaNet by excluding transactions that do not impact cash flow (by differentiating accrued interest expenses pertaining to non-monthly payments, for example).

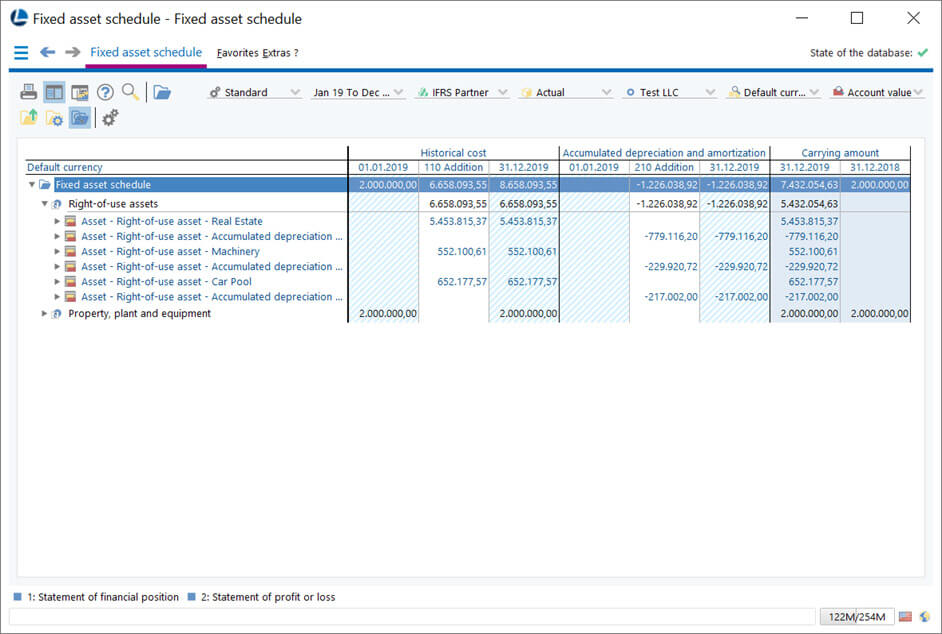

Question 5: How do I handle additions to right-of-use assets?

The transaction types also enable you to present additions to right-of-use assets – as well as all other transactions, such as disposals or remeasurements – in a separate schedule.

Question 6: How should I approach the maturity analysis according to IFRS 7?

IFRS 16.58 requires that you, as a lessee, disclose a maturity analysis on future lease payments in accordance with IFRS 7 – one that is separate from maturity analyses for other financial liabilities. Since undiscounted lease payments must be factored into this maturity analysis, the tool calculates all contracts with a discount rate of 0% in the background. The lease payments will then be posted to statistical accounts and split into:

- a short-term (up to one year),

- a medium-term (between one and five years), and

- a long-term portion (after five years).

More information on IFRS 16, a leading topic at present

Are you looking to learn more about lease accounting in accordance with IFRS 16? Then be sure to stop by our website on the subject:

You can also download our flyer on the LucaNet lease accounting app: