How Can Finance Professionals Stay Relevant in 2021

“Change is the only constant.”

As cliché as the phrase may be, there is never a time more relevant to discuss the persistence of, and need for, change. The pace of adoption of technology over the last 12 months is a sign of things to come. The pandemic forced businesses to rejuvenate their processes and their digital transformation strategy. Beyond the grand upheaval of our norms lie opportunities to reshape the ‘new normal’ – a more digital, and hopefully more inclusive and flexible one. Naturally, change will inevitably be accompanied by a degree of anxiety.

What does this mean for us, finance professionals?

We need to adapt to stay relevant. Several terms feature frequently in opinion pieces – ‘automation’, ‘disruption’, ‘outsourcing’. A PwC study of 32,500 people’s hopes and fears for 2021 revealed that 60% (19,500) of the respondents were worried “automation was putting their job at risk”, and that 39% (12,675) believe their “job will be obsolete” by 2026. These fears are legitimate. Yet, I am a strong advocate for the opportunities that these disruptive technologies bring; these new technologies are gaining traction for being solutions to problems, after all. For example, automation by way of Robotic Process Automation (RPA) eliminates the need for an actual human to perform repetitive, rules-based, tasks like copying data from one place to another for reporting. The time saved could mean we have more time for value-adding work (I elaborate on this later), or finally pursuing a much-revered work-life balance.

Before discussing how we can adapt to a changing business environment, allow me to reflect on some of the ways our industry has changed:

How has the industry changed?

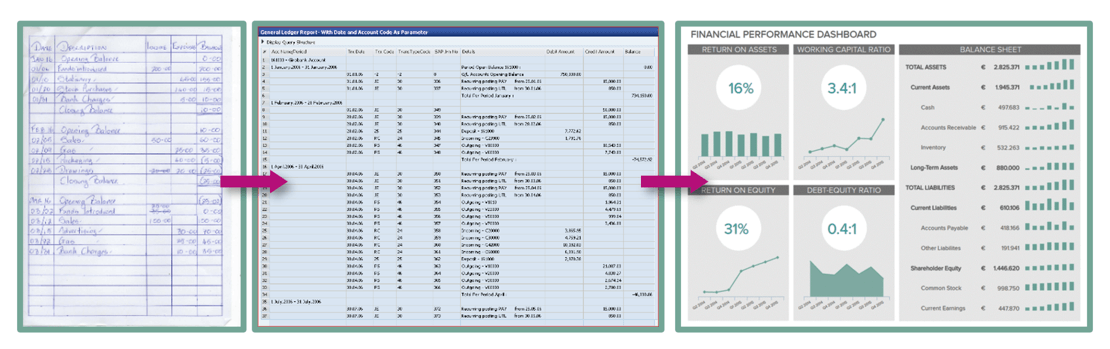

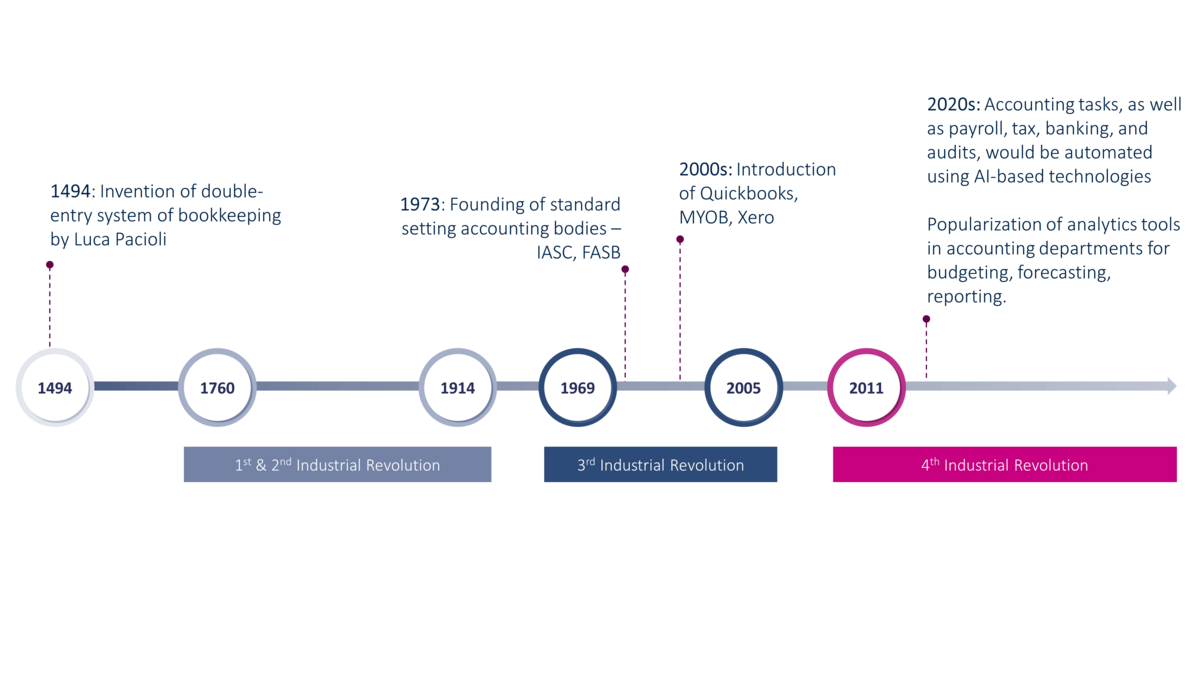

The need for Accounting stemmed from a need for reliable, comparable information – this remains constant. However, how this information is being delivered has changed drastically. Accounting has gone through many overhauls: starting with double-entry bookkeeping, to spreadsheets, to accounting software, and now the application of artificial intelligence.

It is interesting to note that the nature of technological development is evolving too. Any new technological tool for Accounting was previously targeted at improving the ease of delivering accurate, complete, and timely financial information. However, in the 21st century, analytical technologies are aiming at aiding our decision-making process – with descriptive, predictive analytics. This is a key development that signals what future developments would look like.

In just over a century, we have gone from paper records to digital records, to more palatable ways of presenting that digital information:

How fast is it changing?

The pace of evolution in the Accounting industry is accelerating. This is consistent with the pace at which our industry is evolving with industrial revolutions too. Significant milestones of change are occurring more frequently, and changes require less time to adapt each time. For instance, the time between industrial revolutions has shortened – from 30-50 years between the first, second, and third industrial revolution to less than a decade between the third and fourth industrial revolution.

The push for ‘digital’ is here to stay. The pandemic is a sullen reminder that change is possible; only if we have the will to embrace it. Many accounting departments which were previously working with physical (paper) documentation were forced to go digital. Companies that were resistant to digital changes were forced to make those changes – instituting Virtual Private Networks, embracing Cloud Computing, as part of their Information Technology. In an unprecedented move – Singapore’s Ministry of Law, in April 2021, extended the legislation allowing for alternative arrangements for these meetings indefinitely. While the pace of change may throttle down, I expect it to be faster than pre-pandemic levels.

What are some skills we might need to stay relevant?

The developments in Accounting Technology acknowledge, implicitly, that the future of Accounting lies in navigating through increasingly unstructured environments in search of more value.

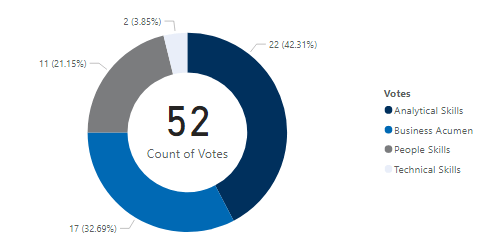

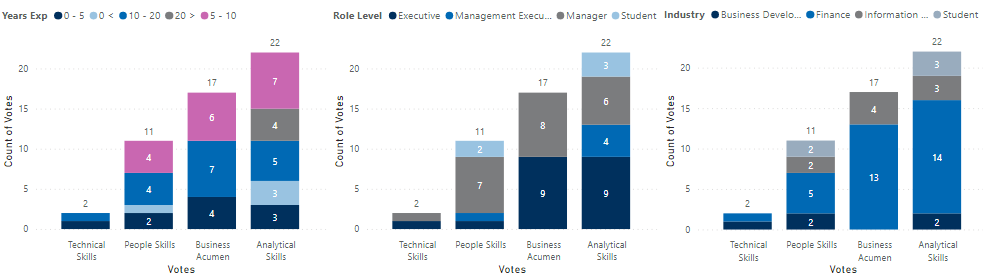

Prior to releasing this post, we asked: “What skill do you believe is the most important for Accountants in the 4th Industrial Revolution?”. Amongst the 52 respondents, Analytical Skills (42%) emerged most important, followed by Business Acumen (32%). The other options were: People Skills (21%) and Technical Skills (4%). This corroborates with our earlier discussion – in the data age, it is important to be able to interpret the information. There is less of an emphasis on mastery of the Accounting standards, to pivot towards value-adding activities.

Some other insights:

- Analytical Skills are the core focus of Management Executives and Senior Professionals: respondents who held C-suite positions responded overwhelmingly in favour of analytical skills. This could potentially signal a present scarcity in such skills, or an increasing need for these abilities.

- Business Acumen and People Skills were more important amongst middle managers: An underlying understanding of the business, and managing people, are key traits required of managers. This could be reflective of the demand of skills that they are facing currently.

The information disaggregated across different dimensions are available below:

How might we go about attaining them?

This non-exhaustive list is intended to highlight actionable ways in which Accountants can effectively embrace change.

1. Computational Thinking

To effectively utilize technology, we must understand how we can translate our requirements and processes to a machine-readable format. The key lies in learning computational thinking – the strategy that utilises powerful ideas in computer science to solve problems.

Many course offerings dive straight into teaching this through a programming language. Such courses offer a quicker launchpad into the space. However, the best digital nomads build fundamentals through learning computational thinking. Some courses to consider:

- Computational Thinking for Problem Solving, offered by the University of Pennsylvania through Coursera (approx. 18 hours) – Structured learning that does a deep dive into the topic.

- Coding, through Codecademy (self-paced) – Learning programming languages through practice. Good once you’ve acquired a basic understanding of the language.

- HackerRank – Allows you to practice coding at different levels of proficiency. Good for maintaining your currency of knowledge.

- UiPath Academy, Robotic Process Automation – A good way to put algorithmic thinking into practice by trying out how to automate tasks.

2. Data and Analytical Skills

With digitalisation efforts in full swing, this means that the amount of data made available for analysis increases with time. This is immediately applicable to accounting transactions – performing analyses on transactional information is easily possible. In the digital economy, data is the new oil.

As Accountants, we need to master the best ways in collecting, storing, extracting, transforming, loading, and analysing this emerging key resource. These are some courses available to help with this:

- Google Data Analytics Professional Certificate, from Google through Coursera

- The Ultimate MySQL Bootcamp: Go from SQL Beginner to Expert, through Udemy – Comprehensive step-by-step guide to learning the Structured Query Language, which is essential for working with databases.

- Microsoft Certified: Data Analyst Associate – Learning about a Visualisation tool, Microsoft Power BI, to explore best practices in visualising the data

3. Business Acumen

Going back to basics is important. As we’re learning how best to interpret data, how best to make our processes more efficient, it’s easy to lose ourselves in this digitalisation craze. Ultimately, we must understand the businesses we serve. Learning about frameworks may help with this, though keeping updated with industry changes alongside experience will aid this. Networking and talking to others help too. A one-stop and cost-effective refresher:

- The Quantic MBA – An online 1-year MBA programme, covering business topics from an entrepreneurial and technological perspective.

4. Project Management

This is a useful skill for delivering more complex, cross-functional projects. At some point, an Accounting department will undertake change – be it process changes, implementation of new systems, etc. These can be defined as ‘projects’, for which project management methods may be useful. Being well versed with project management skills ensures that business objectives are delivered in line with expectations. There are tools to help us reduce risks, manage costs, and improve project success rates:

- Certified Associate in Project Management – learning about Project Management skills

5. Technical Knowledge

Despite automation reducing the need for manual work, the initial set-up of these algorithms necessitates an Accounting professional. We are still in the best position to advise companies on relevant changes required. These are some ways to keep abreast with the latest updates:

- IFRS Foundation’s Work Plan – useful to keep updated with changes in standards and the considerations underpinning these changes.

- Introduction to sustainability reporting and the GRI standards – Sustainability reporting, first mandated by stock exchanges in 2016, is becoming increasingly adopted. The IFRS Foundation has also contemplated whether it should make a foray into the sustainability reporting space. This should be something Accountants look keenly at.

It may also be useful to refer to the Skills Framework for Accountancy, published by SkillsFuture Singapore, to get a sense of what skills are perceived to be required. While the list of skills required might lengthen and change with time, skills like Communication, Change Management, and Financial Analysis will continue to be relevant.

Accounting: The Language of Business

This remains something we can continue to find solace in. Through facts and figures, we Accountants help corporations by becoming business advisors. We can employ new technologies, paired with enhanced skills, to add value to our businesses. In the future of Accounting, we go beyond merely being a compliance function – to being an advisory one. The language of business is dynamic, and Accountants are well-poised to speak it in a value-adding way, more so than ever before.

With this knowledge, accountants are now skilled for leveraging on tools that can super-charge their work. LucaNet offers intelligent Financial Performance Management (FPM) solution made by finance for finance users. With LucaNet, finance professionals can now take the complexity out of data collection, consolidation, budgeting and reporting. Learn more about LucaNet's FPM solution here: