How to Incorporate Big Data Analytics into Finance

Table of contents

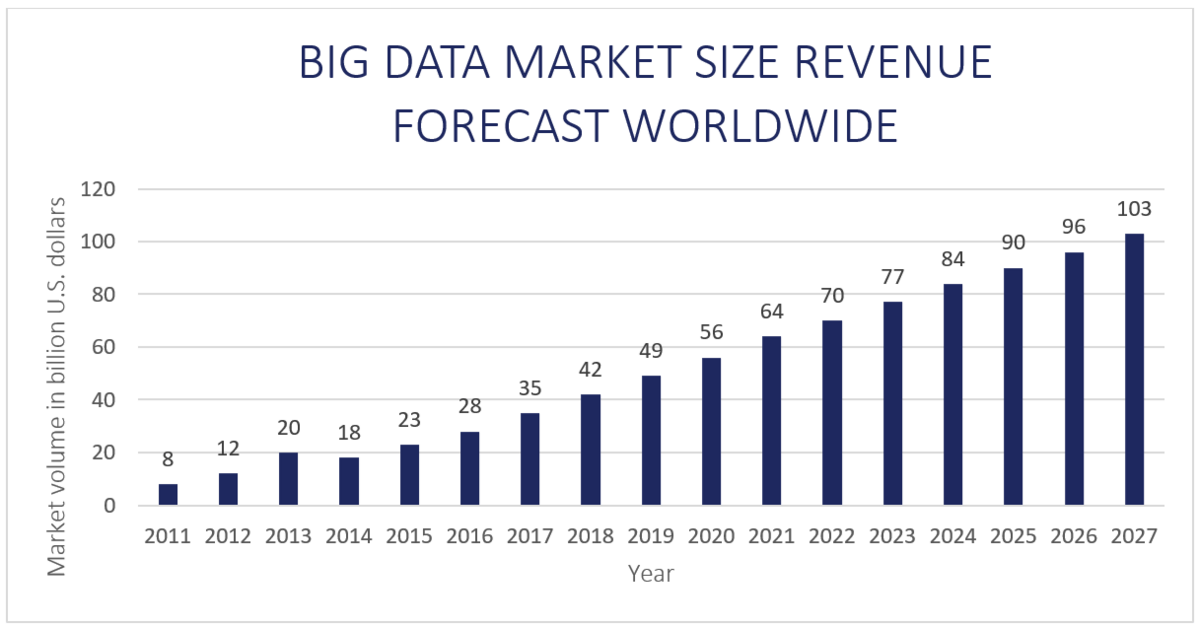

Big data is a huge buzzword that has been thrown around in today’s fast-paced business environment. Technologies such as Machine Learning, AI and data analytics are increasingly utilised by companies to build up visualisation capabilities and simplify complex datasets. As such, the big data market is thriving and is expected to reach a valuation of USD 103.65 billion by 2027.

The rise of big data has been accompanied by the growing adoption of data analytics in organisations. Most companies have realized the importance of utilising analytics to boost their companies’ operations. For example, auditors can use regression analysis to form audit expectations using an explicit, mathematically objective and precise method. Forecasting using time series analysis also develops insights in developing inventory strategies on existing items, new products and product phase-outs, taking seasonality into account.

Are you looking for ways to improve your company’s performance? Here are some steps that you can implement to help your company build your very own data analytics capabilities.

Preparing your finance team for data

Sowing the seeds of change is a continuous process. On order to prepare your team to benefit most optimally from this wave of change, we suggest two preparatory steps: (1) changing mindsets, and (2) increasing the organisation’s data maturity. Having a strong foundation enables the organisation to benefit from the power of data analytics most effectively and extensively. We elaborate on this below:

Changing mindsets to embrace the potential of data analytics

Firms are often driven by values, which helps the management develop criteria by which prioritisation decisions are made. This is especially useful in a large and complex company, where employees are trained to make independent decisions about priorities that are consistent with the strategic direction and business model of the company. However, these values might enroot the firm, preventing it from adapting to change.

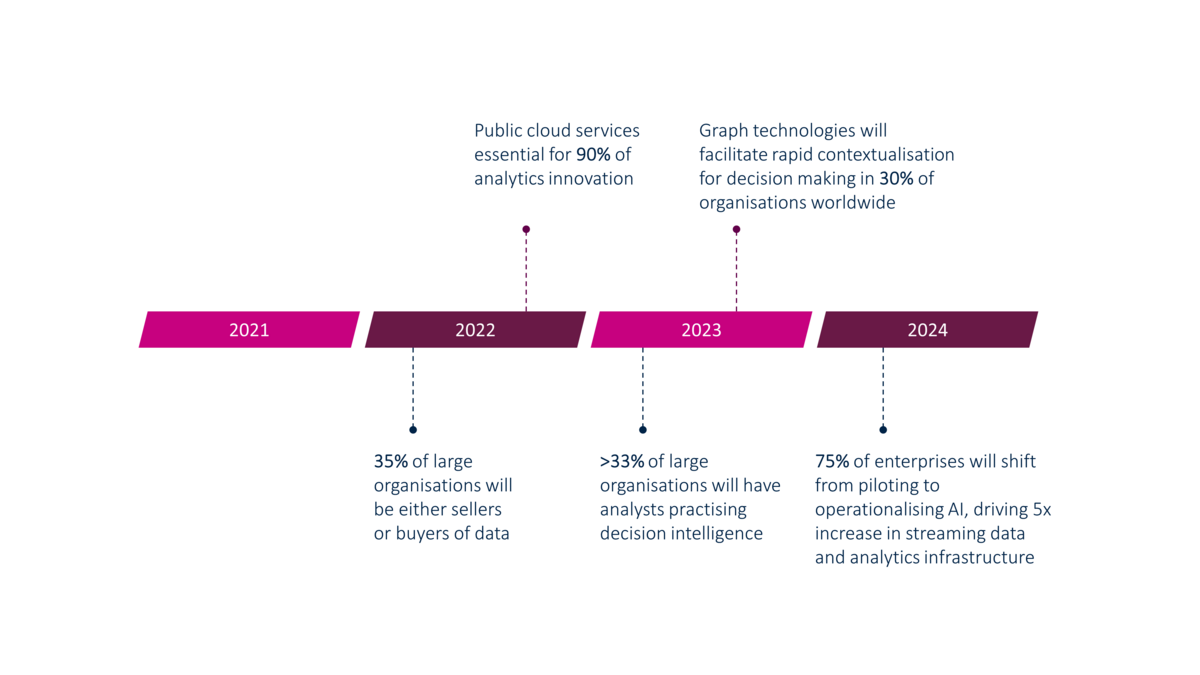

It is important to change mindsets and embrace the changes that data analytics can bring about. The timeline above shows some trends in data and analytics identified by Gartner. By 2022, 35% of large organisations will be either sellers or buyers of data, while in 2023, more than 33% of large organisations will have analysts practicing decision intelligence. Such statistics show how data-driven companies are, and how this demand for data will only continue to grow. Companies need to keep up with technological advancements in data analytics, or they risk losing out to their competitors that act first.

Clear and measurable improvements must be shown to convince the management that data analytics solutions are needed. One way of tracking such improvements could be by setting up a heavyweight team for a project to improve or create a product. Heavyweight teams involve members from different functions cooperating with each other, which works well for such projects. Data analytics could be incorporated midway through the project and improvements to the project could be tracked using pre-determined measures. Since the project is still on a small scale, the cost of implementing data analytics will be minimal, while the impact can be measured accurately since only one project’s performance will be tracked. During the review of the project’s performance, it is also important to note the way that analytics was used, because ineffective usage would not be an accurate measure.

Increase your data maturity level

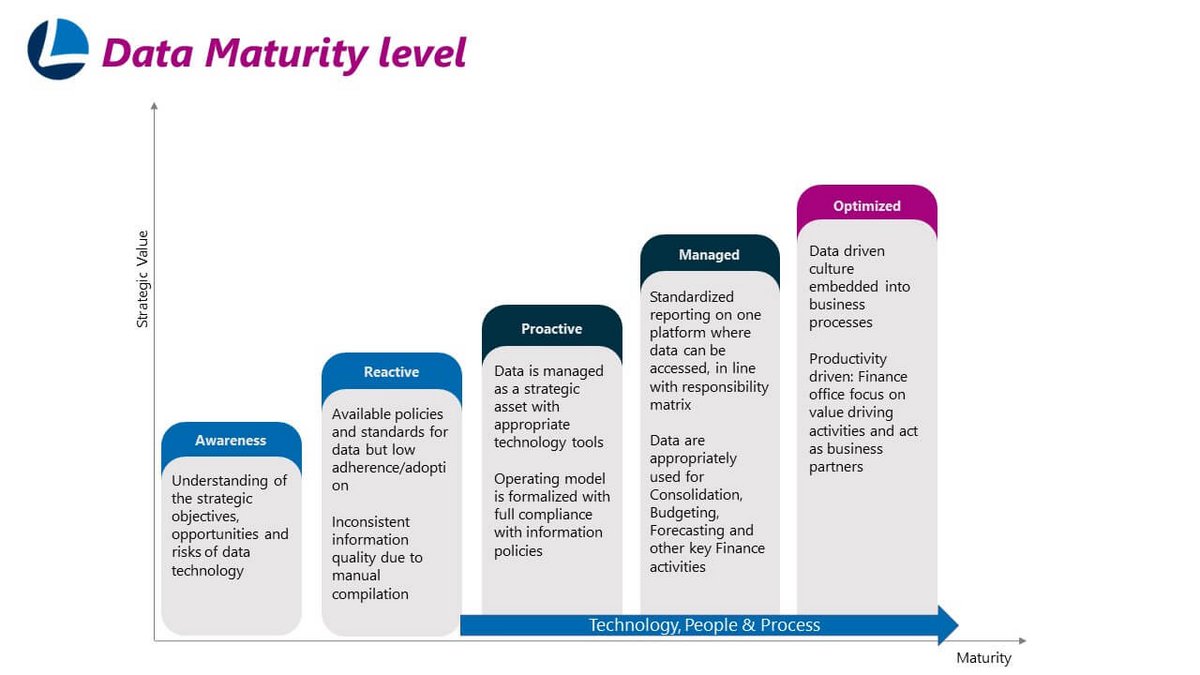

Data analytics requires big data technology, which requires a large amount of data that must be collected over the years for an extended period. One way of checking if your company is ready for the implementation of analytics would be a data maturity level assessment. Time and resources must be allocated for this collection of data, but this step is important to prime your company for the transition to utilising analytics.

journey on the right track. Here are the three main questions that your organisation should think about:

- Is the data accurate? Aside from collecting enough data, it is also important to collect data of good quality. As the saying goes - “Garbage in, garbage out”; feeding flawed input data would produce erroneous “garbage”. As a good practice, tech giants Google and Facebook properly label the data they collect, to fit against their respective goals while ensuring that there is sufficient diversity in the data. It is important to use a properly focused lens to obtain quality data to ensure that the data collected is not accurate or complete.

- Is this data meaningful? Identify the pain points that your organization wishes to gain insights on. Will the data analysis facilitate your goal? If not, what other sources of data can you obtain? It is also important to consider whether the insights are useful from the users’ perspective. Such insights brought about by analysing the data should facilitate end users’ decision making to add value for the company.

- What can we measure and analyse? Different business operations have different events and KPIs, and it would be redundant and costly to track every minute in detail. Identify the key events to be tracked and have a standard KPI list. This creates a framework for your organisation's data analytics process that allows a stronger focus on specific aspects of your business.

Such questions and preparatory steps pave the way for a proactive data analytics implementation process.

Follow-up from Preparatory Steps

Having made some preparatory steps, the team is ready and well-poised to take on specific topics on amassing the potential of big data. Here are some suggestions:

Utilise analytics software

The importance of data analytics in today’s world has created the demand for software with different features and capabilities. Such software commonly offers dashboarding and reporting capabilities, while disruptive newcomers continue to bring in new technologies to provide organizations with more ways to discover and prepare data for analysis.

Having in-house big data and analytics software would allow companies to better streamline their procedures. One of the main benefits of having in-house software would be that it has a high level of customisation, meeting your company’s required specifications and covering all aspects of the business without unnecessary extras. However, it requires time, effort, and an extensive number of resources to make it happen, thus a long timeframe is required. For example, you would need to hire in-house developers that have the knowledge and expertise to create sophisticated software capable of handling the tasks you require. Companies are required to make investments of strategic commitment to developing their in-house analytics software, thus they would require more resources and technological process.

A quicker solution would be to outsource analytics to external companies. In the current business environment, there are many fintech and data analytics firms that have developed their unique software for specific purposes. Looking at such solutions and pinpointing them to match with your current goals could be a quick and easy solution. One major player in enterprise BI and analytics is Microsoft, with its flagship platform, Power BI. Microsoft Power BI is used to gather insights from an organisation's data by connecting various data sets, transforming and cleaning the data into a data model, while creating visualisations of the data through dashboarding. LucaNet also provides seamless integration of BI and dashboarding tools such as Microsoft Power BI. This allows us to help our clients view and share their financial figures in various formats through centralised, interactive and mobile dashboards and diagrams.

For organisations that are resource-rich and heavily data reliant, developing in-house capabilities might be more suitable. In the long run, the benefits brought about by analytics usage should pay off the initial cost incurred for the development of the software. On the other hand, growing companies can consider outsourcing analytics capabilities, as it provides the agility for them to find an immediate solution while incurring a lower initial cost.

Train your employees

Utilising a new form of technology requires time to get used to. However, employees have a higher tendency of sticking to the status quo. Development programs for data and analytics should be invested in to increase the skills and competence of the employees in maximizing big data’s potential. These advancement opportunities can also increase employee’s commitment and satisfaction, which helps to reduce turnover and increase productivity.

This can be done in a form of organisational learning in three stages:

- Knowledge acquisition: Employees should be encouraged to attend courses that teach them the importance of analytics, and how to leverage such techniques. Professional accounting bodies like the Institute of Singapore Chartered Accountants already provide courses that give participants a hands-on experience of working with data analytics, allowing them to learn how analytics can be involved in their day-to-day work.

- Knowledge sharing: Employees should be given opportunities to disseminate what they have learnt. This can be done through sharing sessions or bonding events within or between departments, allowing them to understand the different ways that analytics can be used.

- Knowledge utilisation: Ensure that your employees have hands-on experience with working with analytics and are ready to apply the knowledge they have learnt to other aspects of the business.

These techniques ensure that your employees can embrace the cultural shift towards data analytics and can make decisions using data insights rather than instinct. Arming employees with both data and the skillsets required to use it helps them make better operating decisions daily, which can benefit your organisation in the long run.

What will be your next steps for big data analytics?

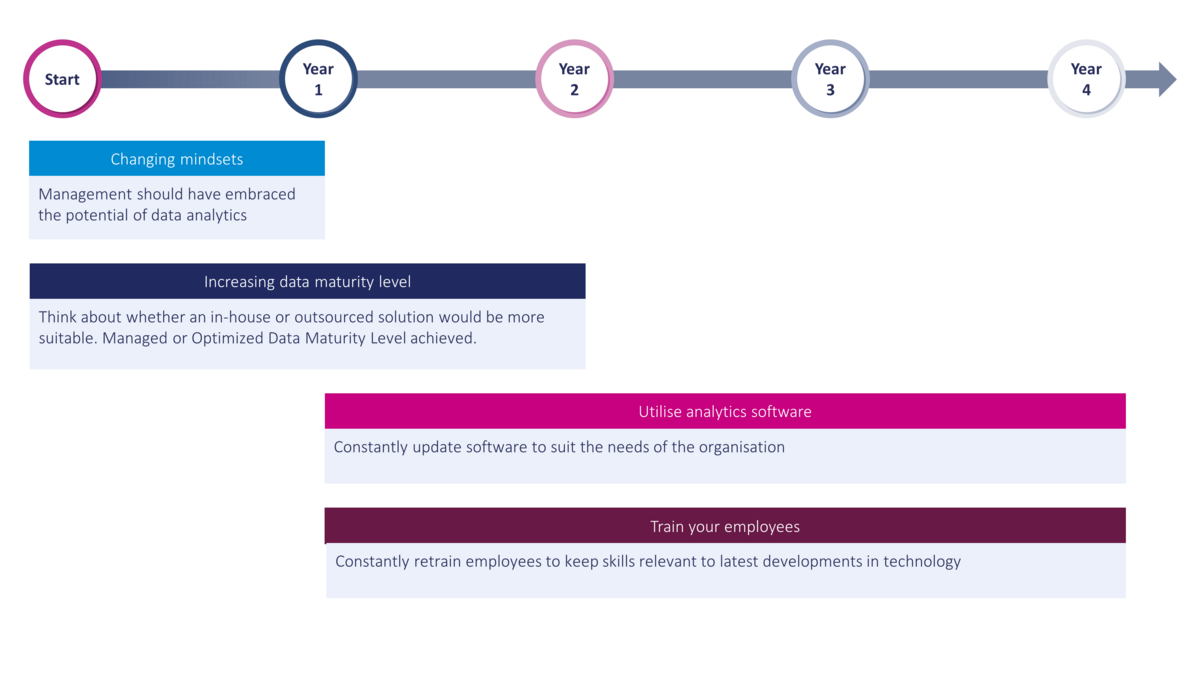

Big data and analytics capabilities cannot be developed overnight, nor is it a static solution. Short term plans must be integrated into long term plans to holistically set up the necessary environment for the incorporation of big data and analytics. The steps above are combined into a possible timeline for your organisation below.

First, begin changing the mindsets of the company’s management while simultaneously improving its data maturity level. Within a year, the management should be ready to embark on the data analytics transformation journey, while having the adequate level of data maturity to commence selecting an analytics solution and training employees. As time passes, it is important to continually reassess the organisation's needs, utilising technological advancements and retraining employees to strive towards newfound goals. Ultimately, any form of analytics must be sought after with the business context in focus. In the coming years, the rapid advancement of technology will continue to bring about unpredictable and uncontrollable changes.

LucaNet software provides seamless integrations with tools like Microsoft Power BI, opening the door to a fully integrated combination of financial performance management and business intelligence. You can learn more about our intelligent solution for BI and dashboarding.