7 Tips from our Consolidation & Reporting Masterclass

How would you describe financial consolidation? The finance professionals we interviewed often describe consolidation as challenging and daunting.

To help finance professionals with their consolidation and reporting woes, our consultants Celestine See and Jeremy Chia gathered their knowledge and put together a masterclass.

In this post, we will summarize the seven tips shared by our consultants on how to overcome challenges related to data collection, consolidation preparation, disclosure management, and reporting.

1. Data collection

Starting with the first step of the process – data collection. In our experience, common challenges concerning data collection include varying ERP systems, different charts of accounts, and deviating fiscal years. It would most likely be a pure coincidence for two unrelated entities to maintain their accounts in the same way. Moreover, the same account may have very different descriptions between two entities, which adds another layer of complexity.

Tip 1: Redesigning the entity-level accounts

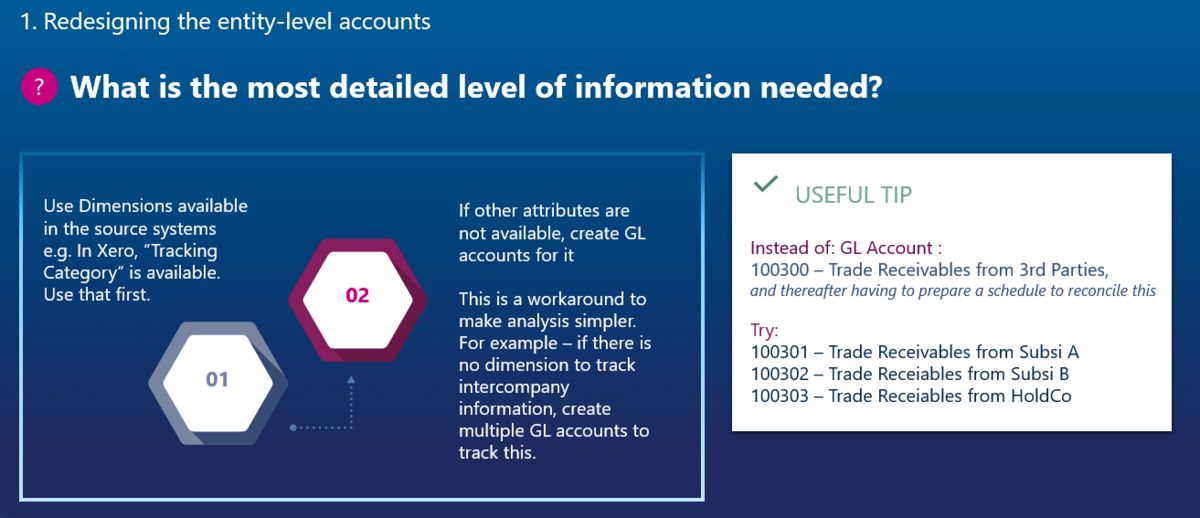

Firstly, we recommend redesigning the entity-level accounts by streamlining different attributes that can be stored together. When analyzing information, less is more – general ledger accounts and attributes should be set up in a way to allow for better tracking and visualization. The first order of preference would be to utilize ‘dimensions’ available in source systems. For example, in some existing accounting software – a ‘tracking category’ will likely be an available option to track the level of information required, such as revenue streams or even different business units.

However, in situations where it is not possible to use dimensions to track certain intercompany information, exploring the option of creating multiple general ledger accounts (i.e. split by one for each dimension) can be incorporated for better tracking.

Figure 1 (below) illustrates a useful tip – consider breaking down one general ledger into sub-accounts that have clearer descriptive purposes. This would make the whole data compilation process simpler downstream when combining information from different entities for analysis.

Tip 2. Maintaining a master copy of all charts of accounts

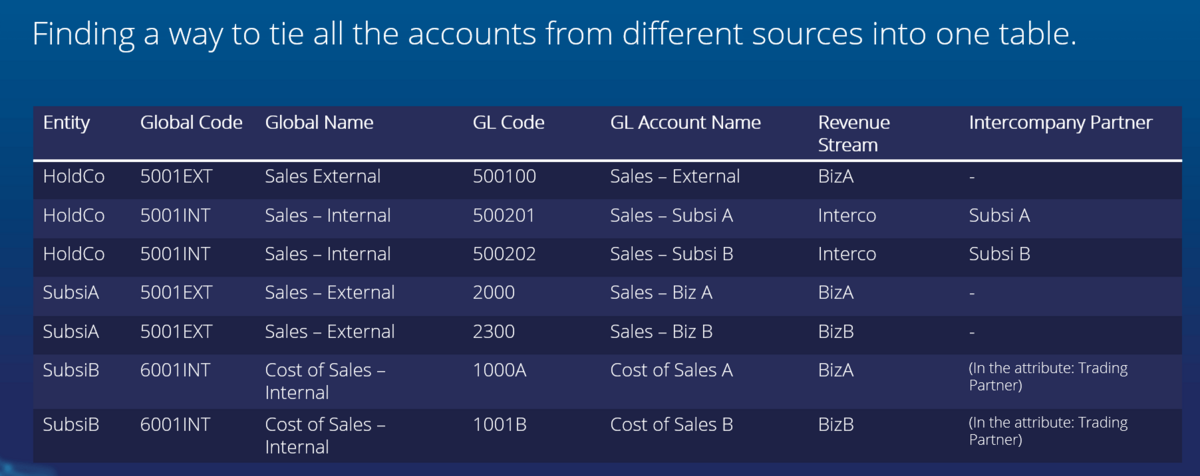

Another area of improvement would be controlling group accounts. We suggest having a master copy of the charts of accounts for the group’s entities and finding a way to tie all the accounts from different sources into one main table for ease of reference.

Figure 2 illustrates a good example. All accounts are linked by a global code and name. This provides a systematic organization of information for your balance sheet and statement of profit or loss. From a process point of view, we would further suggest having a group accountant control the master copy of the charts of accounts, which would allow an improved awareness and oversight over the various accounts for the whole group of entities.

2. Consolidation preparation

Moving on to consolidation, common challenges that our clients have faced include the possibility of multiple layers of consolidation, lack of transparency for consolidation journal entries (CJEs), and even complexities arising from foreign exchange rates. As both historical CJEs and intercompany transactions would be difficult to trace back accurately, a lack of continuity and data accuracy would be a potential obstacle for companies to maintain an efficient operating process.

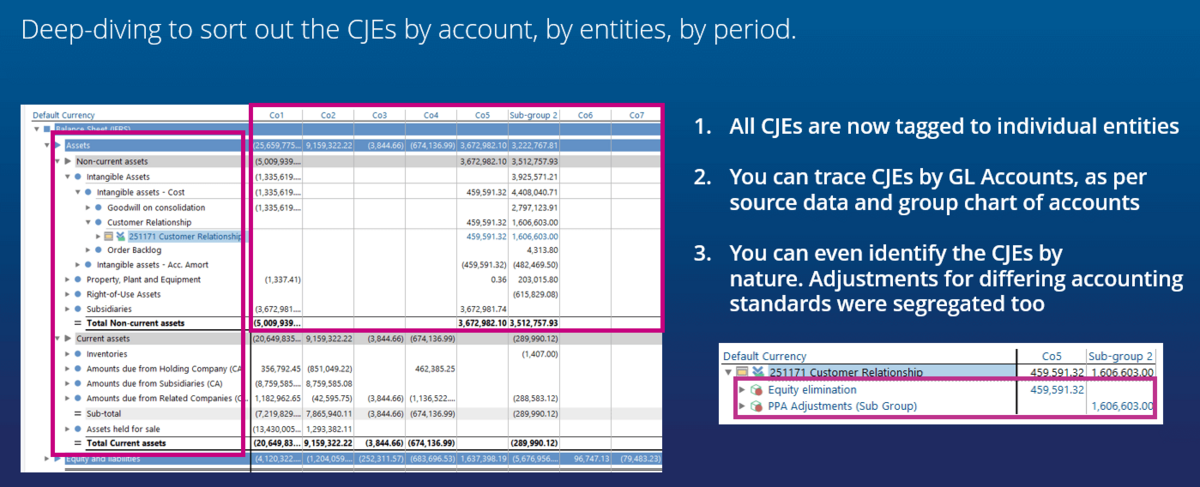

Tip 3: Setting the right fundamentals – data accuracy before finance automation

We would suggest for the team to focus on the accuracy of data before moving on with the automation process. By incorporating new columns in your CJE template formats, the overview of CJEs by entity level is much clearer, as the respective segment as well as the GL account of the CJE will be shown. Preparation of segment reports would be carried out effectively and efficiently, as your finance professionals will be able to track the CJEs by their general ledger accounts, as per source data and group chart of accounts. Furthermore, these CJEs can even be further segregated by their nature and accounting standards. This would provide a time-efficient alternative to your consolidation preparation process.

The effectiveness of striking a problem at its root will be apparent. Clean data would serve as a strong foundation for effective automation of the consolidation process. Your finance teams will then be able to optimize their time to provide the valued information and analysis for critical business decisions.

Tip 4: Combining detailed information with effective finance automation

Drilling down to the source of data collection, we would suggest implementing a comprehensive Standard Operating Procedure to record transactions with intercompany information in your ERP systems. With the magic of the Extract, Transform, and Load (ETL) process, we will be able to provide an automated solution by extracting source data with intercompany tagging to improve the intercompany elimination process for you. Our clients have feedback to us that

“My auditor wants to review our consolidation only in LucaNet, and not the manual Excel”

Here’s an overview of their CJEs in LucaNet.

3. Disclosure management

Disclosure management provides an alternative integrated approach to automate the production of accurate financial statements, with the added benefits of flexibility for various output formats. Hence, to capitalize and streamline the last mile of finance with a disclosure management system, the key will lie in incorporating standardization, structure, and centralization within a decentralized team. Before discussing possible steps, here are some questions to assess the effectiveness of your current disclosure management process:

- How confident are you that all changes to your data have been accurately captured in your financial statements?

- Are your validation rules comprehensive enough to ensure accuracy?

- How many professionals in your team are involved in the preparation of the financial statements?

Tip 5: Incorporating standardization, structure, and centralization in a decentralized team

By incorporating a standardized reporting package, we will be able to streamline how your data is reported. To start, we would typically suggest reducing the numbers of existing reporting packages and consolidate all of them into one standard reporting package. We can then further capitalize your system’s capability to build multiple validation rules, which greatly reduces the time taken to ensure the disclosure of sufficient and accurate information.

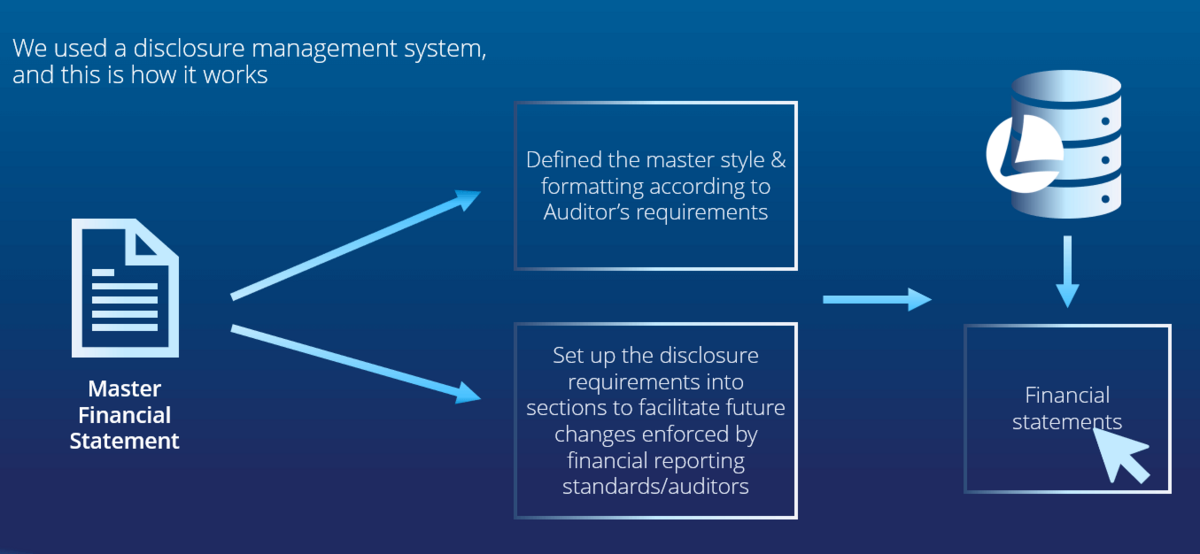

Tip 6: Utilizing a disclosure management solution

Regarding financial reporting standards, the master style and formatting of the financial statements can be clearly defined to identify and facilitate future changes required. You will have the capability to conduct an immediate review of the increased quality of disclosures, with prior delays arising from linkages across multiple spreadsheets eliminated. By integrating the LucaNet database into your procedures, with simply a click of a button, the entire set of financial statements will be generated and updated.

The team will therefore be able to leverage the revamped process to prepare their financial statements in a timely and accurate manner.

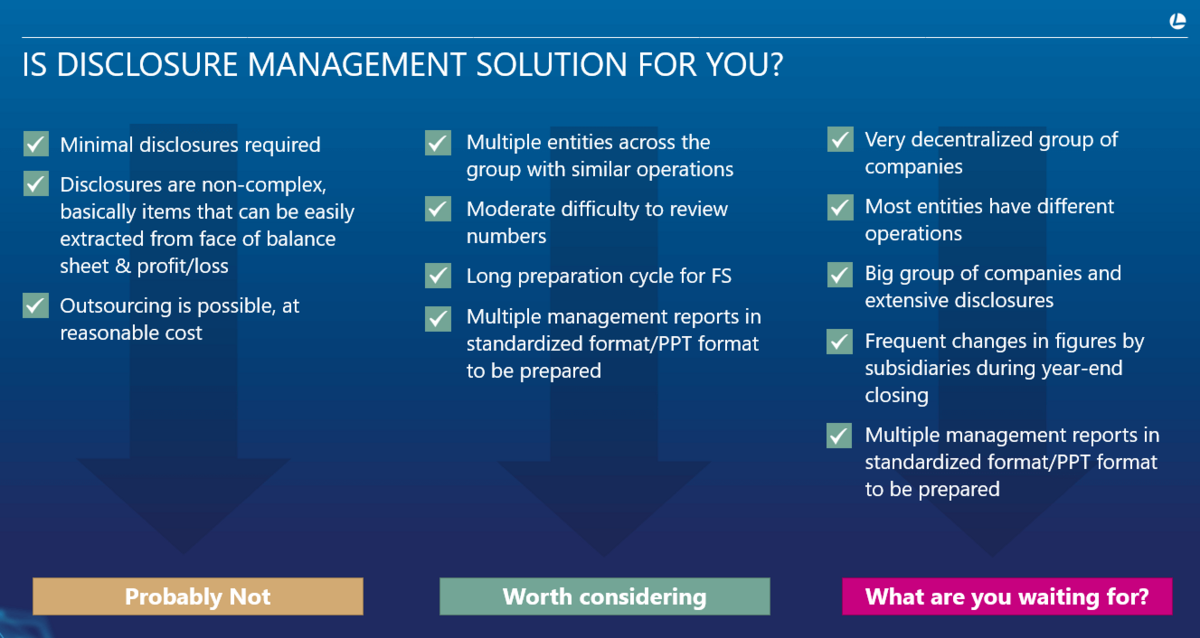

Is a disclosure management solution suitable for you?

However, implementing a disclosure management solution comes with its costs. Not all teams are suitable to adopt a solution right off the bat. There could be instances where minimal disclosures are required, or where outsourcing is possible at a reasonable cost – a disclosure management solution might not be the most ideal then. On the other hand, for a group of companies that face decentralized issues, yet require regular, extensive disclosures, we suggest employing and leveraging our proposed solutions to eliminate the complexity and build a sustainable efficient system for your finance teams.

We do believe that before embracing a disclosure management solution, one would have to weigh and consider the relevant costs and benefits. Here’s a suggested checklist on a list of factors that you should consider before making this decision.

4. Reporting and analytics

Accounting is the language of business, where finance professionals should seek to provide more than just compliance services and instead, undertake opportunities to generate more purposeful and value-added information for analysis.

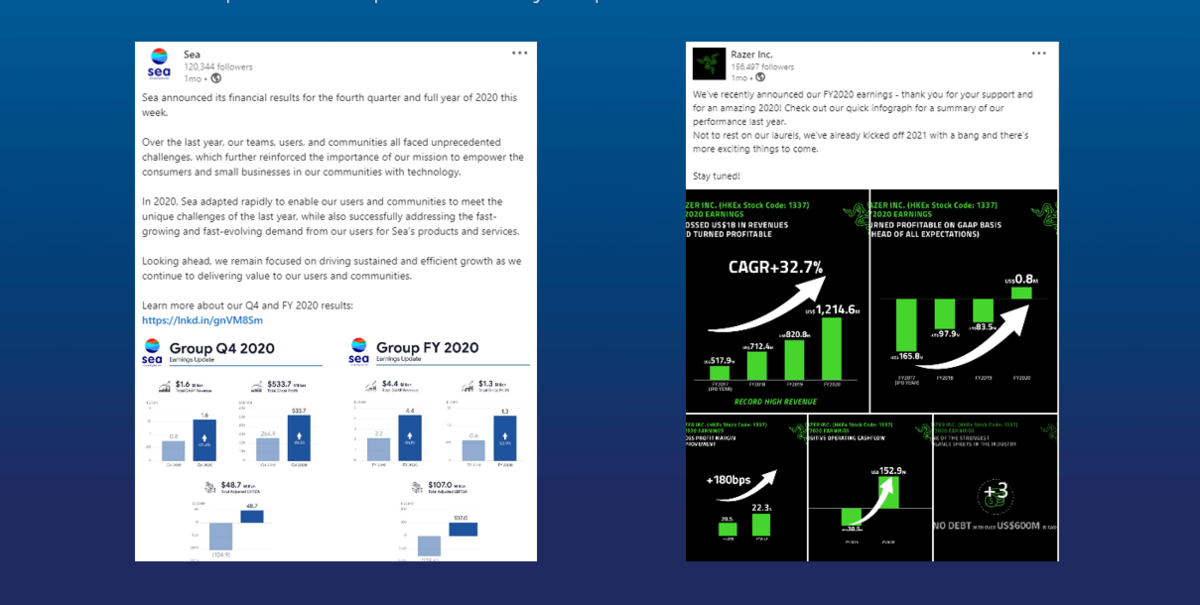

With the rapid advancement of technology, procedures are becoming more time-efficient in providing accurate and useful business data and insights. Hence, accounting and finance professionals will be required to deliver detailed graphs and charts that highlight various key reporting results to management and shareholders within a shorter period of time. In recent years, we have noticed that leading companies communicate their financials in innovative manners. Here you can see two examples of SEA Group and Razer reporting their financial results on LinkedIn.

With easy-to-read graphs and clear segmentation based on various business units, financial reports advance beyond just lengthy annual reports.

Tip 7: List of guiding questions for effective financial reporting

There are tons of financial data which can be grouped and dissected in multiple ways. Which numbers are essential to communicate to which stakeholders? How can we go about presenting these numbers? And what is the end goal that we would like to achieve? These are important questions to ask before building up your financial reports. Here’s a framework on a non-exhaustive list of guiding questions for effective financial reporting:

- What is the business context?

- Who will be using this information?

- What are they used to seeing?

- What will they do with this information?

- Are there any potential constraints?

There is a tendency for finance teams to focus overly on visuals when creating new financial reports. However, we would like to emphasize the importance of taking the first step to understanding the use of data. Reports are made to answer and guide business decisions, and it is important to think these questions through to produce reports that are meaningful to the stakeholders.

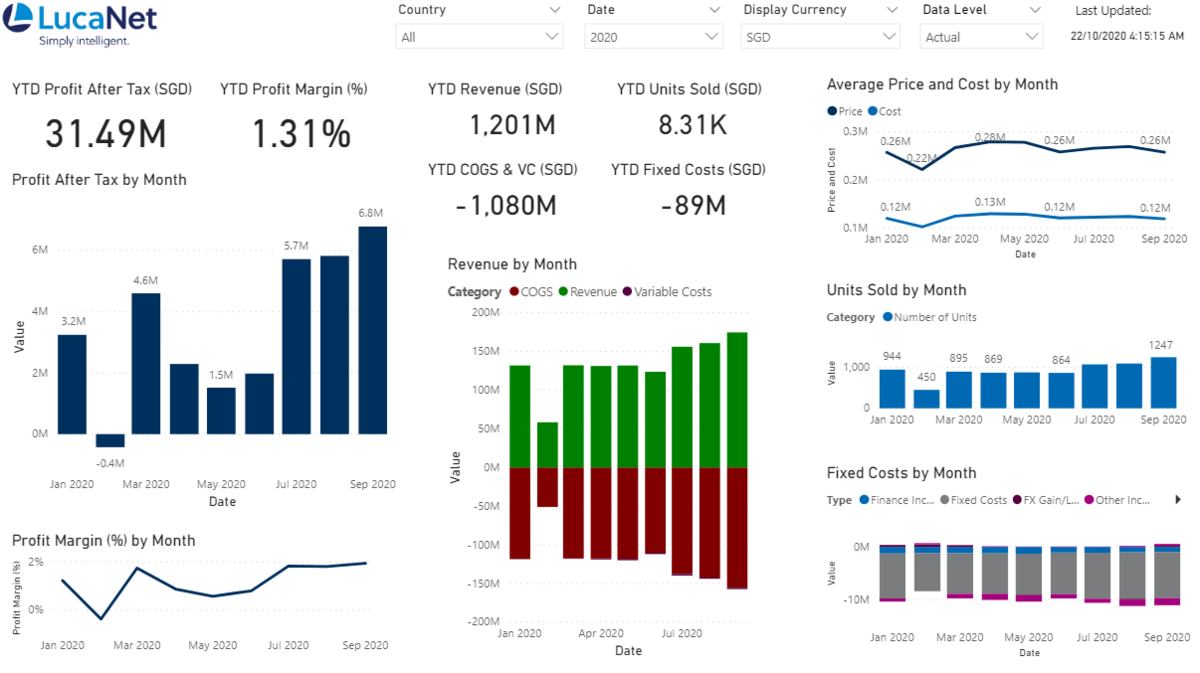

After planning, finance teams can leverage the wide variety of Business Intelligence solutions to create dashboards. Here’s a sample of a Power BI Dashboard we have created for our client.

Layering tools like Microsoft Power BI with LucaNet, the dashboard provides a greater holistic view of key information for the operations, which enables smarter data-driven decisions to better respond to the changing market conditions. Businesses can now keep up with rapid changes while staying agile with powerful reporting tools to visualize and analyze real-time financial information.

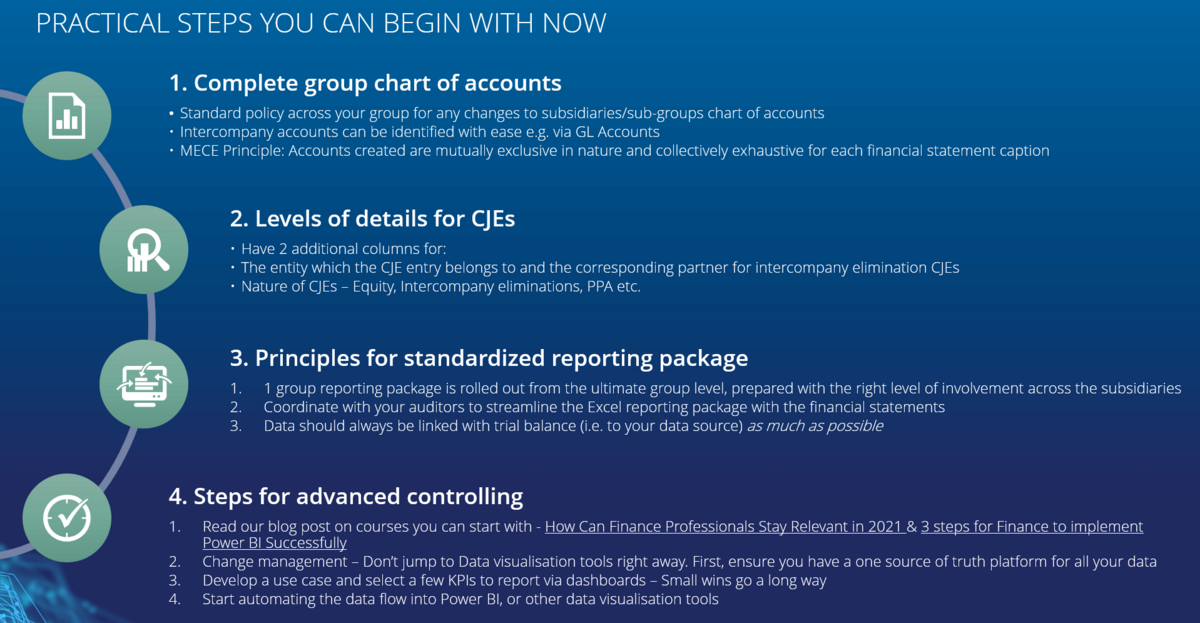

What are the practical steps you can begin with now?

In summary, here is our list of practical steps you can begin right now to optimize your consolidation and reporting process:

Every company has the desire to have time-efficient and robust operating procedures in place so that financial data are processed in a fast, simple, and automated way. The tips we have compiled will help you take the first step in improving the consolidation and reporting process for your businesses.

LucaNet Consulting – Simply Intelligent

The accountant of the future must be multi-faceted – to be equipped with strong technical, analytical, and management skills. Hence as an Accredited Training Organization (ATO), our consulting team in LucaNet is well-experienced to provide tailor-made digital solutions for your finance teams to embrace the new era of technology. We offer intelligent Financial Performance Management (FPM) solutions that take the complexity out of your consolidation and reporting process while arming your finance professionals with both the data and skillsets required to be one step ahead of the competition.

For full details on our tips and tricks, head to the on-demand webinar recording of the ‘Consolidation & Reporting Masterclass’ hosted by LucaNet & DigitalCFO Asia.

WATCH MASTERCLASS ON-DEMAND